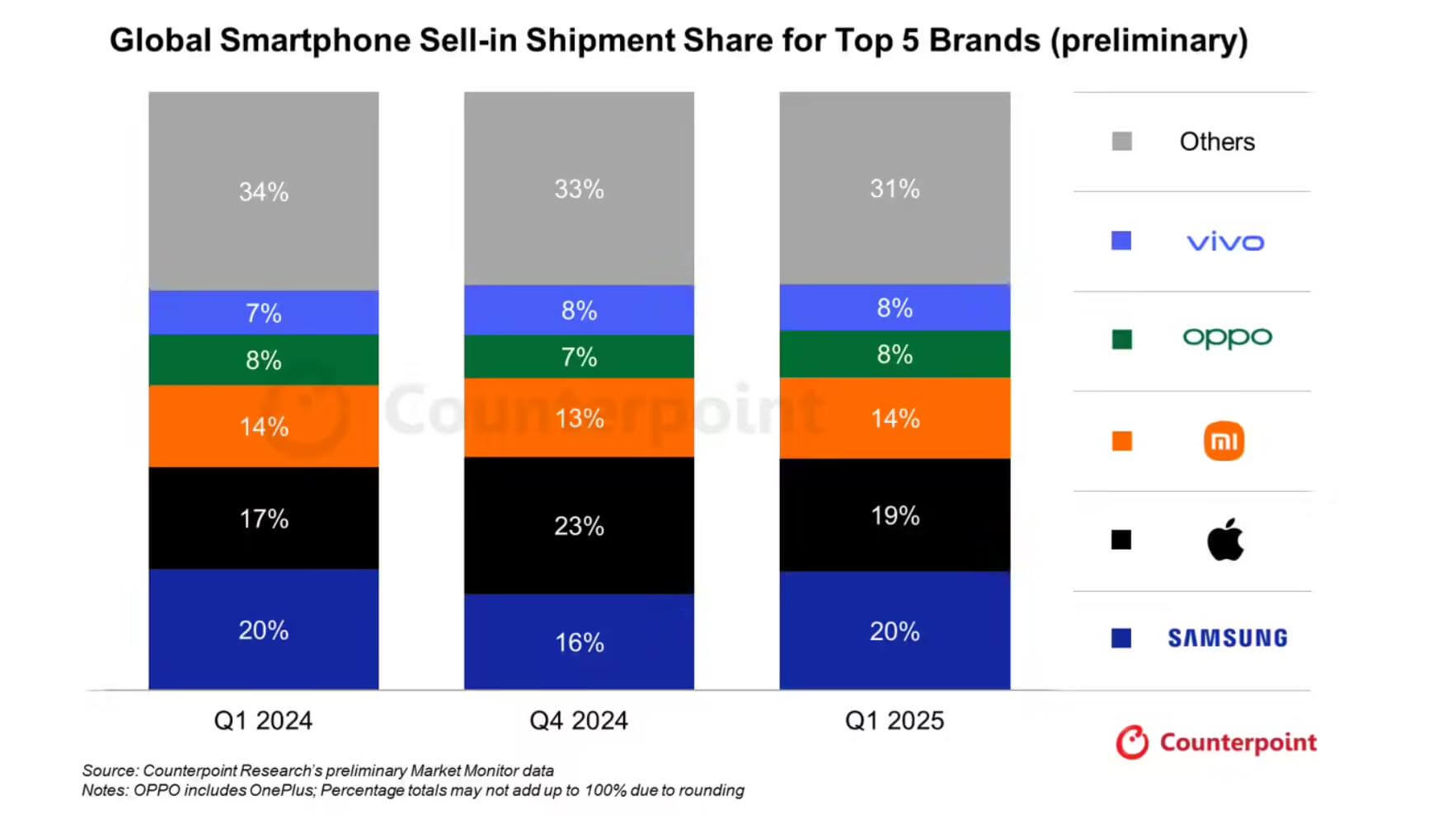

Recently, the market research firm Counterpoint Research released the global smartphone shipment report for the first quarter of 2025. It reported that the global smartphone shipments in the first quarter of 2025 increased by 3% year – on – year, and the surging demand in the Chinese, Latin American, and Southeast Asian markets was the main driving force.

The global smartphone shipments in the first quarter of 2025 increased by 3% year – on – year. At first glance, this data is gratifying, but behind it is a complex market game. The surging demand in the Chinese, Latin American, and Southeast Asian markets has become a powerful engine driving global growth.

However, the market growth is not smooth sailing. Senior analyst Yang Wang pointed out that the growth was originally predicted to reach 6%, but the uncertainty of tariff policies at the end of the quarter, such as tariff fluctuations caused by the adjustment of trade policies in some countries, has left mobile phone manufacturers undecided in terms of raw material procurement and product pricing. At the same time, original equipment manufacturers (OEMs), out of concerns about market risks, have adopted a cautious inventory strategy and dare not rashly carry out large – scale production and stockpiling. These factors have led to the actual growth falling short of expectations. Yang Wang even downgraded the growth rate forecast for 2025, stating bluntly that market uncertainties will continue, and the annual growth may approach zero or even fall into a negative growth dilemma. This means that the global mobile phone market still needs to break through many obstacles in the subsequent development to return to a stable growth track.

Brand Competition Pattern: The Strong Remain Strong and There are Many Variables

(1) Samsung: Multiple – pronged Efforts to Consolidate its Throne

Thanks to the launch of the Galaxy S25 series and the update of the A – series in the mid – to – low – end price range, Samsung’s shipments have increased significantly, and it has once again topped the global list with a market share of 20%. In the high – end market, the Galaxy S25 series attracts consumers who pursue extreme experiences with its cutting – edge screen technology, excellent imaging system, and powerful performance. In the mid – to – low – end market, the A – series is popular among emerging markets and price – sensitive consumer groups with its rich functions and affordable prices. Samsung has consolidated its market position by accurately arranging products to cover different consumption levels.

(2) Apple: Ups and Downs under the New Product Strategy

Apple rarely launched a new product, the iPhone 16e, in the first quarter. This product has won market share in markets such as Japan. Japanese consumers have a unique preference for small, exquisite, and powerful electronic products, and the iPhone 16e just meets this demand, receiving a good response in the local market. However, in terms of sell – in shipments, Apple ranked second with a market share of 19%. Previously, in the sell – through shipment report, Apple ranked first. The change in rankings under different statistical calibers reflects that Apple has certain differences in channel inventory management and product sales rhythm control. At the same time, in other global markets, Apple faces many challenges. For example, consumers in some emerging markets are more price – sensitive, and the relatively high pricing of Apple products limits its market expansion.

(3) Xiaomi: Expanding Markets and Brand Advancement

Xiaomi’s global mobile phone shipments ranked third, with a market share of 14%, a year – on – year increase of 2%. In China, benefiting from national subsidy policies, the Xiaomi 15 series has shown strong sales performance. As of April 6 (W14), the activation sales of the Xiaomi 15 series exceeded 3.93 million units, leading the domestic flagship models. Moreover, Xiaomi is actively expanding overseas markets, especially in emerging markets such as India and Southeast Asia. Through cost – performance advantages and localized marketing strategies, it has won a large number of users. In addition, Xiaomi’s investment in the electric vehicle field has enhanced the overall technological image of the brand, feeding back into the mobile phone business and enhancing consumers’ perception of the high – end nature of the Xiaomi brand, gradually gaining a firm foothold in the global market.

(4) OPPO and vivo: Seeking Breakthroughs in Competition

OPPO and vivo tied for fourth place, both with a market share of 8%. Vivo is the fastest – growing brand among the top five, with a year – on – year growth of 6%. Vivo has attracted many young consumers in the domestic market by optimizing product design and enhancing imaging technology. OPPO has achieved sales growth in the Indian, Latin American, and European markets, but in the international market, it still needs to deal with fierce competition. For example, in the European market, facing the encirclement and suppression of Samsung, Apple, and local brands, OPPO needs to further enhance its brand awareness and optimize its product layout to gain a greater advantage in the competition.

Regional Market Differences: Opportunities and Challenges Coexist

From a regional perspective, different markets present very different scenes. In the Chinese market in the first quarter of 2025, shipments increased by 3.3% year – on – year, with a growth rate higher than the global average. Xiaomi ranked first with 13.3 million shipments, and Huawei, OPPO, and vivo also performed well. The international brand Apple experienced a 9% year – on – year decline. At the same time, the advantages of Chinese manufacturers in technological innovation and product cost – performance make Chinese mobile phones highly competitive in the local market.

The Latin American and Southeast Asian markets have become important drivers of the growth of the global mobile phone market. The economies of these two regions are developing rapidly, and the penetration rate of smartphones is constantly increasing. A large number of consumers are purchasing smartphones for the first time or upgrading their devices. For mobile phone manufacturers, this means broad market space, but it also faces many challenges such as localized operations and channel construction, such as adapting to the unique cultural preferences and consumption habits of local consumers and building an efficient sales and after – sales network.

In the North American market, the demand for smartphones is relatively weak. On the one hand, the market saturation is high, and the consumer replacement cycle has been extended. On the other hand, factors such as the adjustment of operator policies and the slower – than – expected 5G penetration rate have affected mobile phone shipments. In such a market environment, manufacturers need to launch more innovative and differentiated products to attract consumers to replace their devices.

Future Outlook: Promoting Sales Growth through Technological Innovation

Overall, the mobile phone market in the first quarter of 2025 has growth highlights and also faces many uncertainties. With the changes in the global economic situation, the advancement of technological innovation, and the evolution of consumer demand, the mobile phone market will continue to shuffle. Brand manufacturers need to closely monitor market dynamics, accurately grasp consumer needs, increase investment in technology research and development, and launch more competitive products. In the high – end market, focus on the upgrade of core experiences such as imaging, performance, and design; in the mid – to – low – end market, pay attention to the balance between cost – performance and functional practicality. At the same time, optimize supply chain management to deal with risks such as tariffs and fluctuations in raw material prices. For emerging markets, carry out in – depth localized operations; for mature markets, explore segmented demands. Only in this way can we ride the waves in the complex and changing mobile phone market, occupy a favorable position, and win the future market competition.