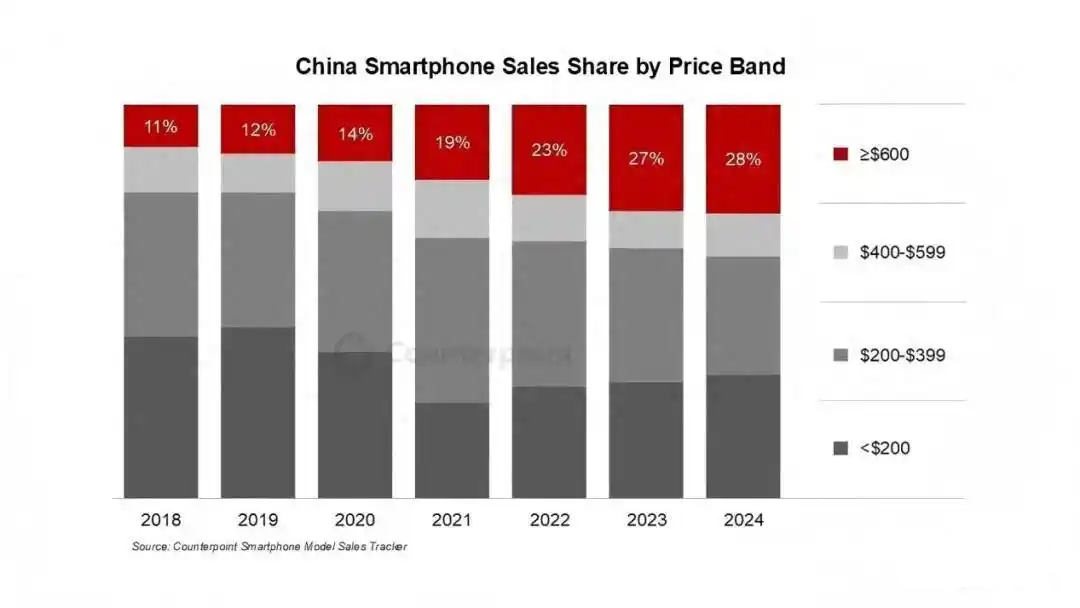

Research institution Counterpoint recently released the “Smartphone Model Sales Tracking Report”, which shows that in 2024, the sales share of China’s high-end smartphones (priced at US$600, RMB 4,350 and above) has climbed to 28% of the overall market, a significant increase from 11% in 2018.

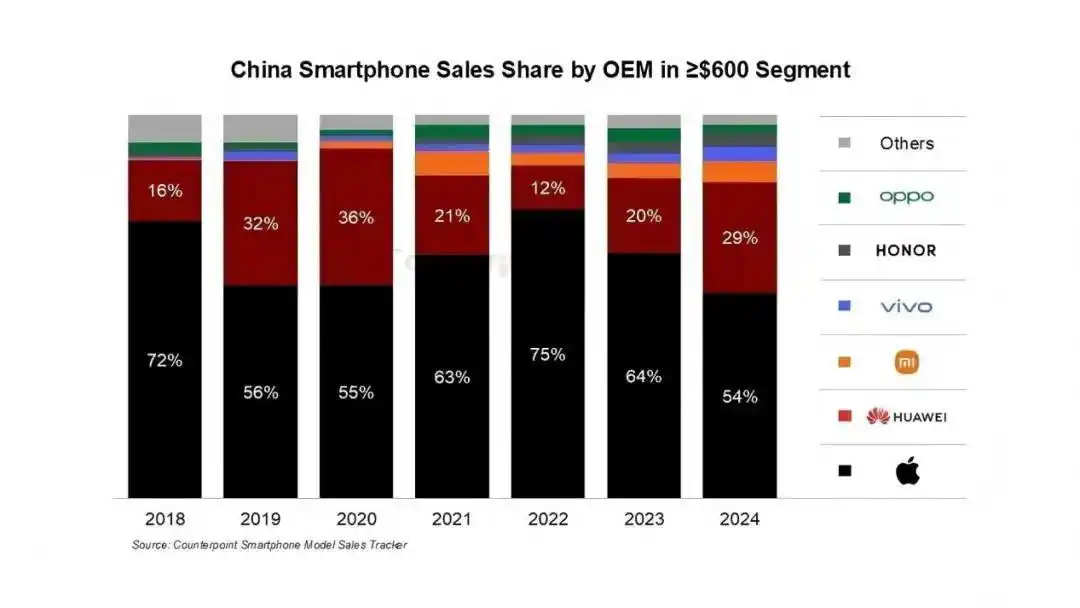

From the perspective of brand distribution, Apple’s sales share in the price segment above US$600 in 2024 is 54%, ranking first, and Huawei ranks second with a share of 29%. Xiaomi ranks third.

From the perspective of sales share changes from 2018 to 2024, although the top three are basically dominated by Apple, Huawei, and Xiaomi, the changes in their shares are not small. Take Apple as an example. Apple’s market share has dropped to 54%, the lowest point in the past seven years, and is approaching the 50% mark.

Huawei’s share in the high-end market has increased from 20% in 2023 to 29%. Xiaomi’s performance in the high-end market in 2024 is also quite impressive, with a year-on-year increase of about 50%.

Although Xiaomi’s overall share is still insufficient compared with Apple and Huawei, its catching-up speed should not be underestimated. In particular, the Xiaomi 15 series launched at the end of last year, according to the previously announced new machine activation data, the Xiaomi 15 Ultra had activated about 2.68 million units 101 days after its launch, while the vivo X200 series and OPPO Find X8 series were 1.57 million and 1.39 million respectively during the same period, which is a big gap.

The sales volume of Xiaomi 15 Ultra on the first day in the Chinese market increased by more than 50% compared with the previous generation, and the pre-sale volume increased by more than 100%, confirming the direct driving effect of the policy on demand. This trend will accelerate the replacement cycle of existing mobile phones and push the industry into a stage of rising volume and price.

The competitive strategies of leading brands such as Apple and Xiaomi have further differentiated: Apple has expanded its user coverage by lowering the starting price of MacBookAir, while Xiaomi has consolidated its high-end market position with AI imaging and performance upgrades. This differentiated competition not only stimulates consumer attention, but also forces the industry chain to increase innovation investment in core links such as sensors and chips.

In addition to mobile phones, wearable devices such as smart glasses and headphones have become new growth points. Policy-encouraged “artificial intelligence +” scenarios, such as low-altitude economy, medical health and other fields, provide terminal manufacturers with cross-industry cooperation opportunities. For example, the “satellite +” action plan in Henan and other places will promote the in-depth application of smart terminals in remote sensing, navigation and other fields.

At present, the consumer electronics industry is in a dual window period of technological dividends and policy support. As AI applications migrate from the cloud to the terminal, intelligence and low cost will become the main line of product iteration, and the expansion of the market scale will further attract capital and technology resources to gather in leading companies.